- A huge two thirds (64%) of real estate lenders anticipate new loan originations to increase this year

- More than half of real estate lenders (52%) expect to expand their team in 2021

- The majority (69%) consider COVID-19 to be the key risk factor to the UK commercial real estate market for 2021

- Availability of loans has dropped across all sectors except Industrial / Logistics

- Ireland is registering the biggest surge in appetite among real estate lenders with a 14% increase on 2020, taking it ahead of Western Europe as the most popular non-UK European location.

More than half of real estate lenders expect to increase the size of their team in 2021 as the sector looks to build back from the uncertainty prompted by the pandemic, according to Link Group’s 2021 Market Trend Analysis report.

While Covid-19 sits at the top of the risk pile, the sector appears to have settled when it comes to the impact of Brexit. Last year, more than two thirds (77%) identified Brexit uncertainty as the main market risk, but this has plummeted to just 2% in 2021.

External risks loom, beyond Covid-19

A UK recession was the second biggest risk factor (12%) to the stability of the UK CRE market in the year to come. With the UK having endured its worst recession in 300 years, unemployment now features as a key concern for (CRE) lenders for the first time since the Market Trend Analysis report first launched five years ago. Despite the government offering further furlough support, an eventual increase in unemployment when the furlough scheme is withdrawn seems inevitable.

Leverage & Pricing – Investment Loans

Most categories of lenders are reducing the maximum LTVs they offer this year, but European banks, Middle Eastern banks and pension funds are bucking the trend. They appear to be continuing the upward trajectory of maximum LTV seen over previous years despite the wider issues encountered over the last 12 months.

The success of the UK vaccine rollout has significantly increased confidence, with appetite for UK business growing. This is expected to prompt a further rise in LTVs as the year progresses.

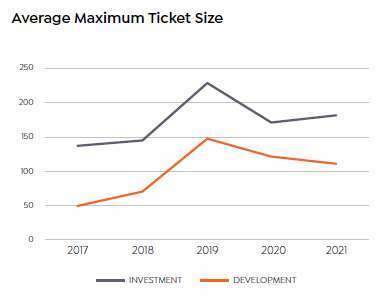

Higher average maximum ticket size for investment loans

There continues to be greater preference for longer-term maturities for investment loans. The largest drop in loan maturity availability for this year was in the medium-dated 6-7 category. Loan availability remained greatest at the medium maturities, this category has borne the brunt of the general decline in loan availability this year.

There has also been a slight divergence in the maximum ticket size for investment and development loans for the first time in five years. Appetite for larger ticket investment loans appears to have increased in this year in contrast to a decline in appetite for large development loans.

The increase in ticket size for investment loans indicates a more optimistic view for investment, especially those in sectors which have now demonstrated themselves to be resilient to the events of the last 12 months.

Robust supply of development loans but investment loan availability has fallen

There has been a noticeable drop in availability of loans generally across all sectors but Industrial/ Logistics, with those sectors most severely impacted by the Covid pandemic having seen appetite to lend dry up most. The availability of loans has fallen most significantly in the retail, hotel and leisure sectors. 2021 is likely to see much larger declines in investment loans in these sectors than in development loans.

The lead times on development projects naturally mean the asset under construction will not earn rental income until it is completed. The fact that activity is holding up better in this segment suggests lenders are more confident about a robust market recovery in 1-2 years’ time than they are right now

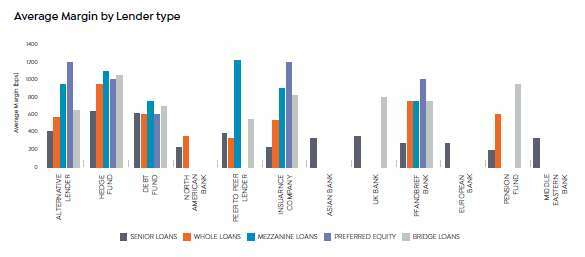

Lenders have reduced preferred equity leverage

When viewed in context of the leverage data, there has been a slight reduction in risk preference. But the only significant change has been at the high side of leverage. This is most likely related to the wider issues caused by the pandemic – for example valuation uncertainty. Loan pricing has also remained relatively static, with a drop in pricing in the preferred equity space from 13% to 10% to make up for the lower leverage on offer.

This has resulted in a narrowing of the gap between mezzanine and preferred equity pricing and leverage, which might give cause for borrowers generally operating in the mezzanine space to consider moving up the leverage curve.

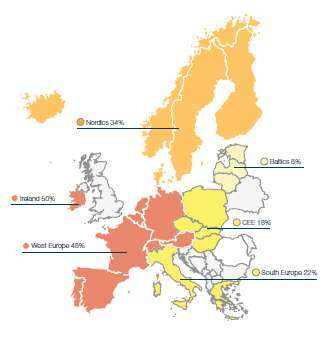

Lenders are keen to expand across Europe

Lenders are more interested in Europe in 2021 than they were in 2020, with an average increase of seven percentage points- across the regions. This may reflect an increase in flexibility in lenders’ investor bases, perhaps being open to new areas geographically in order to have greater access to the best transactions on the market, especially post Brexit.

Ireland is registering the biggest surge in appetite with a 14% increase taking it ahead of Western Europe as the most popular non-UK European location. The strength of ties between the UK and Ireland makes it a natural first port of call for UK-based lenders looking to diversify away from the domestic market.

Tim Schuy, Head of Real Estate Finance at Link Group, said: “The last year has brought extraordinary change to the real estate market, and with it, we have seen huge opportunities develop. As the UK’s big clearing banks stepped back from new business so as to limit the impact of what is now riskier lending on their capital ratios, the field has opened up for alternative lenders to meet demand for refinancing and new project funding. This has resulted in overall stability in pricing and limiting the reduction in sector-specific availability.

“Levels of uncertainty in the sector are certainly higher than usual, something that is to be expected in the wake of a once-in-a-generation global pandemic. We will have to wait and see just how quickly and sustainably the economy can reopen and what that means for the real estate market. But the levels of optimism within the sector are hugely encouraging, and lenders are eager and well placed to seize the growth opportunities that the next 12 months provides.